are dental implants tax deductible in ireland

Your dentist would not implant them unless they were a medicaldental necessity even if the procedure was elective. Just go to wwwrevenueie and see the Med 2 form.

Dental Implants Dublin Replacing Teeth Crown Dental

While dental implants arent specifically mentioned in IRS Publication 502 the IRS says.

. Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. Some services are covered through PRSI dental benefits medical card entitlements and private dental insurance. There is a small catch though.

While not specifically non-deductable and pub 502 has a paragraph on artificial teeth stating they are deductable Iwould imagine you. It also explains Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of. You can deduct 5.

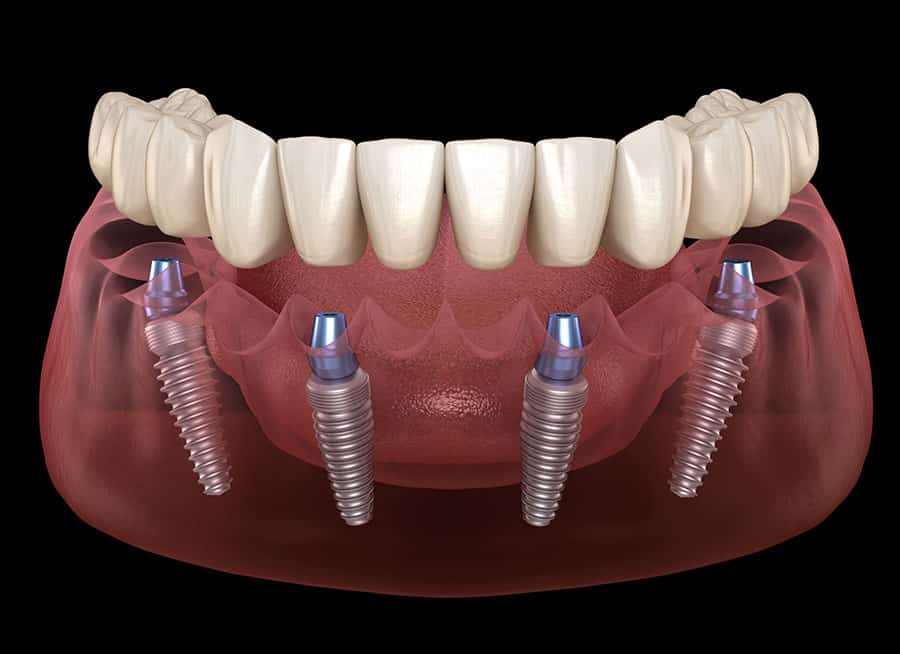

One full arch of teeth four dental implants. This includes fees paid to dentists for X-rays fillings braces extractions dentures etc. Yes dental implants qualify as a tax-deductible medical expense under current Revenue.

Lets say you make 40K a year. Dental Implants are covered by your Med Form 2 Claim which enables you to claim back 20 of the cost of the dental work from Revenue Ireland when you do your yearly tax returns. You would have to eat the first 3000 of those expenses before it starts lowering your tax obligation.

Post Core 150. The good news is yes dental implants are tax deductible. You can only deduct expenses greater than 75 of your income.

The amount of tax you can claim on non-routine dental expenses is 20. The good news is that will include all of your medical and dental expenses not just your dental implants. Pre-tax deductions also reduce your exposure to FICA payroll taxes employee share is 765 for incomes below 148100.

When you are considering dental implants or travelling abroad for dental implant you need to think that with the 20 rebate on taxes in Ireland keeps the overall costs down for you without travelling. An FSA also provides the highest percentage of dental implant discounts because you avoid a third levy type and have no expense floors to surpass before the savings kick in. Per the IRS Deductible medical expenses may include but arent limited to the following.

Many specialist dental treatments are also tax deductible. You must have the dentist complete a Form Med 2 for your claim. A good things to remember is that anything 75 of your gross total income is tax deductible.

Yes dental implants are an approved medical expense that can be deducted on your return. Can You Claim Dental Implants On Taxes. Any 7 should be remembered as a good thing.

How to claim dental expenses. How to claim dental tax expenses in Ireland. However its not automatically deducted you will need to itemize your deductions.

Tax relief is not available for the cost of scaling extraction and filling of teeth or the provision of artificial teeth or dentures. If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. You should also know theres a four-year limit on claims for repayment of tax.

The placing of Dental Implants is a surgical procedure so dental implant dentists like Dr Luana OConnor are very careful in the pre-surgical to make sure the patient is ideal for dental implantsThe placing of dental implants should only be undertaken by a dentist who has had the training to perform this procedure. Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan. After your treatment your dentist should give you the form Med 2.

Dental Implants All on 4 with over 20 years experience. If you received treatment over a year ago its required that you complete a separate Med 2 for each year. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI.

Dental treatment consisting of an enamel-retained bridge or a tooth-supported bridge is allowable. You can include in medical expenses the amounts you pay for dental treatment. Can I deduct the cost of my all on 4 dental implants All-on four.

Dental implants are considered a medical expenses. So if youve paid for non-routine dental treatment during that time you could still claim tax back. To qualify for relief the dentist must be a qualified dentistry practitioner under that countrys laws.

This one says anything 7 is a good thing to do. With effect from 1 January 2010 a tapering restriction applies to individuals with income in excess of EUR 125000 before claiming the specified tax reliefs with the full restriction applying to. 22 2022 Published 512 am.

You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. Any 7 should be remembered as a good thing.

The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. To claim tax relief on non-routine dental expenses you must. Payments of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners.

You can claim for non-routine dental treatment performed outside of Ireland. In todays economy people working for an average salary of 50000 a year are responsible for 3750 in dental costs. Certain tax breaks available to high income earners are restricted eg.

Each Dental Care Ireland practice provides a clear and transparent treatment pricing list. Dental implants are tax deductible so thats good news. Various property based tax incentives film investment relief.

To claim for non-routine dental expenses youll first need to get a completed Form Med 2 from your dentist. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you.

Yes Dental Implants are Tax Deducible. The - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. You can deduct 5 of your gross income.

You are going to be able to deduct dental implants because they cost less. Dental implants are tax deductible so thats good news. The only dental work that is not covered is cosmetic work such as teeth whitening which is not.

Are Dental Implants Tax Deductible. We regularly compare our prices with practices in Ireland other practices in the UK and you will find that we always represent excellent value for money with no compromise in the quality of our services treatments patient care. Taxes on your gross income are deductible by 5.

7 Reasons Why Implants Fail Smile Store

Dental Implant Restoration Tralee Susan Crean Dental Aesthetics Tralee

Dental Cover Cuts Have Hurt But There Are Still Some Things To Smile About

Zirconia Crowns Implant Retained Denture Rehabilitation

900 00 Per Implant Helping You Smile Again Dental Implants Ireland

Importance Of Proper Cleaning Maintenance For Dental Implants

Teeth In A Day At Mydental Clinic In Dublin 8 900 Mydental

Click Tite Dentures Explained Seapoint Clinic Dental Clinic

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Zirconia Crowns Implant Retained Denture Rehabilitation

Dental Implants Specialist Dental Treatment Dental Clinic

How To Avoid Common Dental Implants Problems

Payment Plan Helping You Smile Again Dental Implants Ireland

Dental Implants Ireland Common Questions Answered Smile Store

Dental Implants Dublin Replacing Teeth Crown Dental

Blog Dental News Updates Smile Store The Dental Specialists

Patient Journey Helping You Smile Again Dental Implants Ireland